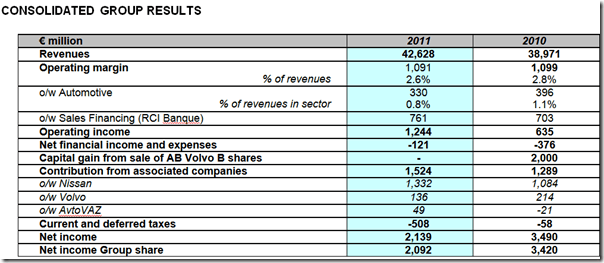

Renault Global Financial results for the year 2011 posts good numbers in terms of profits and operating margins. Group revenues came to €42,628 million, up 9.4%. Driven by sales momentum and an improved product mix, Automotive contributed €40,679 million to revenues, an increase of 9.4% on 2010. Group operating margin was stable at €1,091 million, or 2.6% of revenues, compared with €1,099 million and 2.8% in 2010.

Automotive reported operating margin of €330 million (0.8% of revenues), compared with €396 million, or 1.1% of revenues, in 2010. The favorable impact of sales volumes (€455 million) and the improvement in costs as part of the monozukuri plan (€500 million) did not entirely offset negative factors, mainly external to the company, such as a €509 million rise in raw materials, a €199 million unfavorable currency effect and a €245 million negative mix/price impact.

In all, the supply constraints stemming from the Japanese tsunami had an unfavorable impact on the operating margin of Automotive of an estimated €200 million in 2011. The impacts were mainly felt in production, commercial offers and logistics.

Net income came to €2,139 million, compared with €3,490 million in 2010, which included a capital gain of €2,000 million from the sale in October 2010 of B shares in AB Volvo. Net income Group share totaled €2,092 million (€7.68 per share).

Automotive operational free cash flow exceeded the objective reaching €1,084 million, having successfully maintained operating performance despite a series of crises (supply constraints, sovereign debt) and having rigorously managed the working capital requirement and investments in an uncertain economic environment.

Some of the highlights of the Renault Group Financial Results 2011 were:

- Group revenues of €42,628 million, up 9.4% on 2010.

- Group operating margin of €1,091 million, or 2.6% of revenues, compared with €1,099 million and 2.8% in 2010.

- Group operating income of €1,244 million, compared with €635 million in 2010.

- Contribution of associated companies of €1,524 million, compared with €1,289 million in 2010.

- Net income of €2,139 million, compared with €3,490 million in 2010, which included a €2 billion capital gain from the sale of B shares in AB Volvo.

- Positive Automotive operational free cash flow of €1,084 million, including €627 million from a favorable change in the working capital requirement.

- Automotive net financial debt of €299 million, down €1,136 million on December 31, 2010.

Considering a health global financial results of the Renault Group and its continued commitment towards India, we expect to see much more growth of Renault in India in the year to come. So far probably the weakest link of Renault India is the penetration of the sales and service network which is a huge factor when buyers consider buying a car in India. Also the cars portfolio of Renault India is limited which is expected to expand with many new launched planned in coming few years the first one being the Renault Duster which is planned for a June 2012 launch. We will keep a look at the developments and will bring you the latest happenings as they happen. Do sign up for our free email newsletter for latest updates and like our Official Facebook Page to stay connected.

check out more-