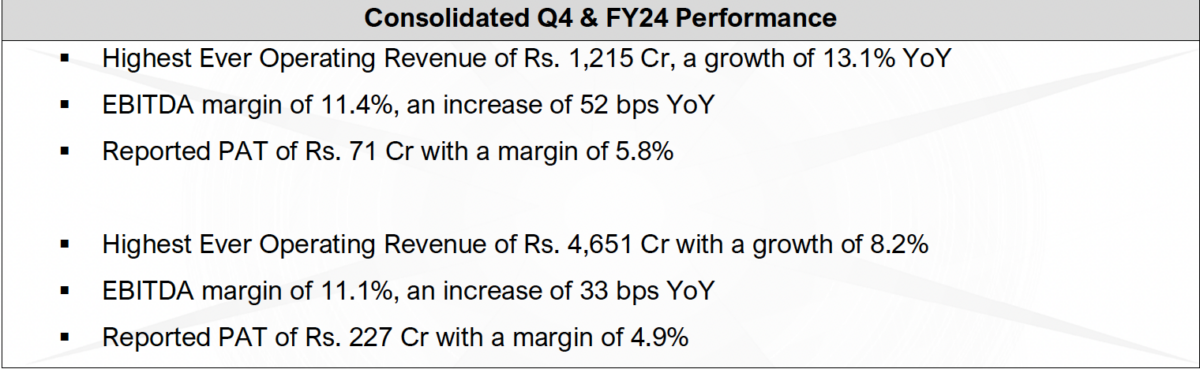

Minda Corporation Limited, the flagship company of Spark Minda, recently released its financial results for Q4 and FY24. With this, the company reports its highest-ever consolidated quarterly revenue of Rs. 1,215 Cr. This translates to a 13.1% YoY growth. This strong performance comes at the back of a wide product portfolio, a growing customer base, and a focus on product premiumization.

Record Revenue and Robust Growth

During the quarter, Minda Corporation achieved the highest-ever EBITDA of Rs. 139 Cr with a margin of 11.4%. This leads to 52 bps YoY growth. PBT reached Rs. 92 Cr, with a margin of 7.5%, and PAT amounting to Rs. 71 Cr with a margin of 5.8%, partially impacted by increase in finance cost and depreciation due to capacity expansion and technological upgrades. Moreover, in the last fiscal, the company bagged lifetime orders of more than Rs 10,000 Cr. Also, EVs constituted 30% of the total orders.

The company even bagged multiple first-time orders for both legacy and new technology products from key OEM’s. Commenting on the results, Mr. Ashok Minda, Chairman and Group CEO said, “Our resilient performance this year underlines our commitment to sustainable business practices and innovation. Achieving record revenue and robust growth reflects our focus on premiumisation and transformation. As one of the leading players in the smart mobility space, our expanding EV order books, investments in advanced technologies and sustainable solutions reaffirm our commitment to driving sustainable growth.”

In recognition of its shareholders, the board of directors has recommended a final dividend of 45% i.e. Rs. 0.90 per equity share on the face value. With this, the total dividend for the year grows to 70% i.e. Rs.1.40 per equity share. The company has even filed 26 new patents this year. With this, it holds 270 patents in its portfolio. Additionally, the company has been granted 69 patents in FY24, which is the highest ever since its inception.

Also Read: Uno Minda Launches Aftermarket 4-Wheeler Rear View Mirrors