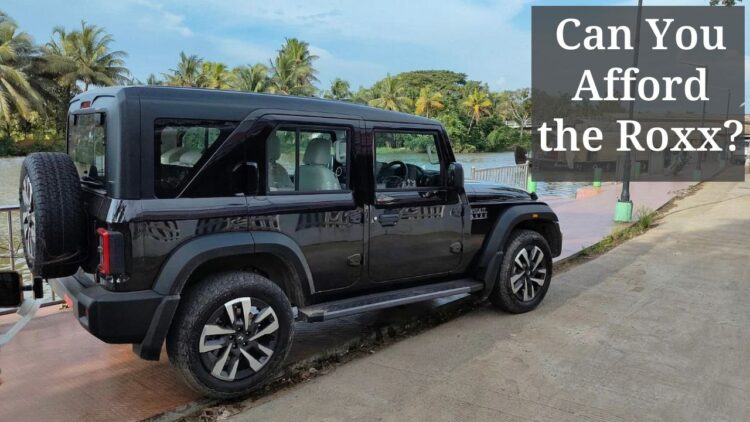

The Mahindra Thar Roxx is the 5-door iteration of the mighty popular Thar and caters to all those who want practicality from their off-roading SUV

In this interesting post, we shall try to figure out what your salary should be if you wish to buy a new Mahindra Thar Roxx. Now, we know that there are innumerable financial experts available online these days. They make interesting content to make people aware of managing their finances. Buying a car is one of the biggest decisions in the lives of most people. In fact, it is a life-long dream for many. Hence, they overshoot their budget to get their dream car. However, that could put you under undesirable stress later on. Let us take a look at what the experts suggest your salary should be to afford the Mahindra Thar Roxx.

When To Buy Mahindra Thar Roxx?

Many financial pundits often speak about the 20/10/4 rule. As per this law, the first part denotes 20% of the on-road price of your vehicle, the second part represents 10% of your monthly salary as EMI of the car and the last part signifies 4 years duration of the car loan. This is the ideal mix if you don’t wish to get into financial trouble at any point in the car ownership. Now, the base model of the Mahindra Thar Roxx costs Rs 15.21 lakh, on-road in Delhi. Therefore, 20% of this amount is Rs 3.42 lakh. This should be the down payment that you must make. For the rest of the amount (Rs 11.79 lakh), you can avail of the loan.

Now, we are assuming an average rate of interest on a car loan for this post to be around 9.5%. This could fluctuate a little on either side in your case due to various reasons. If we take the loan for 4 years, the EMI comes out to be Rs 29,620. If we want this to be 10% of our salary, you need to be earning Rs 2.96 lakh per month to afford the Mahindra Thar Roxx. This translates to Rs 35.52 lakh annually after taxes. Clearly, this seems outrageous since only a fraction of the population makes that kind of money. Sure, there is flexibility to this rule as per your circumstances. Still, this should serve as an example of how to ensure that owning your vehicle doesn’t become a problem for you to maintain.

Our View

I understand that this might seem too extreme to most people. On top of that, buying a car is an emotion. Therefore, people often stretch their budgets in this case. But you should make some basic calculations to figure out what the vehicle will end up costing you for a 5-year ownership. Most people never go through that logic and often complain about their financial situation later on. In inference, I would encourage our readers to go through this mantra, make the necessary adjustments, and then decide how to budget for a new car. In the long run, peace of mind is above everything else.

Also Read: Here’s How Much Salary Do You Need to Buy Tata Punch?