Toyota India has achieved a new milestone by starting its own financial wing in India called the Toyota Financial Services(TFS) India which is a wholly owned subsidiary of Japanese automobile giant Toyota Motor Corporation. The financial company of Toyota got an approval under the Non-Banking Finance provision in India this year and it will starts its operations in India starting 5th June 2012 in India starting from two prominent cities – Delhi and Bangalore. The Headquarters of TFS India will be in Bangalore while the Credit Operations team will work out of Delhi. TFS will provide attractive and special financing options for Toyota car buyers in India. To start it operations in India, Toyota Finical Services Corporation has invested a sum of Rs. 260 Crore in India. In coming year, the TFS India is expected to launch its operations pan India.

Special Features Of Toyota Financial Services In India

There are some key features which differentiate Toyota Financial services from other banking finance companies which will attract more Toyota car buyers to select TFS India over other finance options. Some of these features are listed below:

- Attractive Rates – Since TFS India provides services specifically to Toyota India car buyers only, it can squeeze more on the interest rates compared to other banks etc. as it can afford to offer lesser margins on finance as Toyota as a brand benefits from the car sales. This provides TFS India an edge over other banks when it comes to the interest rates and charges on a loan.

- Quick Approval – Toyota Financial Services claims to offer loan approvals in 8 working hours after the required documents have been submitted with them. They will provide updates and notifications to the customers about the approval process by fast mediums like SMS and email with a centralized approval system in place.

- Easy Documentation – Documentations and formalities related to loans does bother car buyers and they tend to appreciate and go for simpler loan documentation. TFS India has tried to simplify the same by reducing the number of pages in the application form, loan agreements and number of signatures to 50% or less compared to typical industry standards.

- Dedicated Finance Executives – Toyota Financial Services will employ dedicated and experienced loan executives who will serve Toyota Car customers at the Dealerships only offering more convenience to car buyers.

- 100% Finance and Insurance Funding – Full or 100% finance on the on-road value of the vehicle is something unique which banks and other financial services don’t offer. TFS India will offer 100% finance on new Toyota vehicles which will help improve the sales for Toyota India. Also banks do not offer funding for paying the insurance premium on the cars, while the TFSI will offer the same. It will also offer more customized and packaged solutions which will also include service and maintenance of the car as one complete financial package.

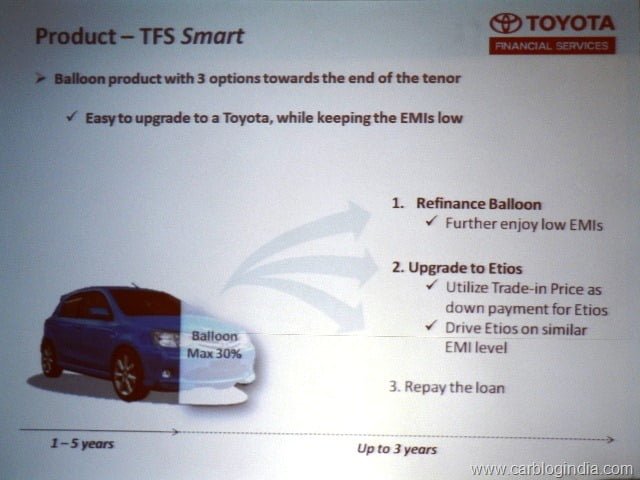

- Extended Tenor And Flexibility – After the completion of tenure, TFSI offers to extend the tenure or trade existing car for a new Toyota car for new finance offer etc. as some of the specials schemes it will offer to its customers in India.

Globally Toyota Financial Services is 30 years old and has operations in 33 other countries making India 34th country in its portfolio. Toyota India sold about 1.3 Lakh cars in the last fiscal (FY 2011-12) and expects to sell about 1.8 lakh cars this year. Out of the total car sales, about 60% to 70% buyers opt for loan or finance. TFS India will try to have more and more share of this 70% sales of Toyota India cars which is a target customers close to 1.2 Lakhs, but considering the TFS India launching its services to start from only two cities, this target audience will be much less to start with. With the experience and maturity of business Toyota Financial services has gained globally, the number is expected to rise gradually in the years to come. Globally, TFS has about 1.5 Billion US Dollars in assets which is a considerable number. TFS India will not offer any direct Insurance or leasing solutions in India.

Speaking on this occasion, Mr. Kazuki Ogura, MD & CEO, Toyota Financial Services India Ltd. quoted:

“We will offer unique finance services through highly trained and qualified Finance Executives at each Toyota dealership. Our objective is to provide Toyota customers with the best auto finance in the market.”

Mr. Sandeep Singh, DMD (Marketing), Toyota Kirloskar Motor quoted:

“TKM has always shared a very good rapport with all our financial partners and we are confident that TFSIN will further help us in our efforts to provide customer delight in owning and driving a Toyota”.